Articles

Avoiding Estate Planning Pitfalls

Preserving wealth for future generations is a significant part of the financial planning process. To help you understand common pitfalls and how estate planning can help you avoid them, we’ve compiled a list of top ten mistakes wealthy families sometimes make in estate planning, which may help reduce estate tax considering the gift and estate tax exemption changes coming at the end of 2025.

How the Government Can Subsidize your Charitable Giving

Structuring how you give leads to giving in the most tax-efficient way possible, which in turn benefits both the charitable organizations and your financial goals.

Top Seven Tax Planning Moves to Make Before Year-End

In addition to everything there is to enjoy about this time of year, it is also important to review and implement any tax-planning strategies. While there are many typical year-end and tax reform items to consider and plan for, here are some that stand out…

Is my retirement plan on track, given inflation and talk of a recession?

As you think about ways you plan to enjoy your retirement, whether it is far in the future or just around the corner, it is natural to worry about your money. In times of economic uncertainty, those worries may escalate.

Investing in Retirement

In retirement, as during your working years, a well-constructed investment strategy considers risk, cost, and asset allocation. When you retire, your financial landscape changes, and your investments may need to change with it.

The Informed Investor: Five Key Concepts for Financial Success

Educated investors are more successful investors. We apply an investment methodology based on Nobel Prize research, an approach crafted to optimize your investment portfolio over time.

Using the Tax-Efficiency of an HSA in Your Financial Plan

What if I told you there is a type of account that combines the best tax savings features of various kinds of retirement accounts, enabling you to get triple the tax savings?

Will the SECURE 2.0 Act Impact Your Financial Plan?

SECURE 2.0 builds on the SECURE Act of 2019. This new law includes myriad changes that will impact most people’s financial plan now or in the future. Let’s dive into the most prominent items.

It’s a New Year: Here’s a DIY Financial Plan Checklist

It seems that everywhere you look – TV, internet, social media – there are ads for all manner of ways to improve your life in the coming year. While you may or may not have New Year’s resolutions, now is a good time to strengthen your financial plan so you are in control of your money. Here is a list of some questions to ask yourself about topics like investments, estate planning, insurance, and taxes:

Do I Need a Financial Planner?

Many people, with adequate time, interest, or knowledge, can go it alone without professional help, and many people benefit from consulting a professional. Should you meet with a financial planner, or can you go it alone?

Should You Stay Invested in Bonds?

While the Federal Reserve continues to raise interest rates to combat inflation, the value of bond holdings have fallen in response, which has many investors wondering if they need to get out of bonds. For long-term investors, this view is short-sighted and ignores the benefit….

Financing Adoption: A Guide for Adopting Families & Their Benefactors

Adoption is a high calling that is exciting but can also be overwhelming. Whether you are a family looking to adopt, you have family or friends adopting, or you just want to help in any way you can, this article is for you.

Expat Finance 101: A Checklist

No matter where you’re headed, the inevitable complexity of living abroad adds challenges for keeping your financial life on track. While many tasks can be completed online, physical and emotional distance can make even simple transactions exceptionally challenging when you’re several time zones away.

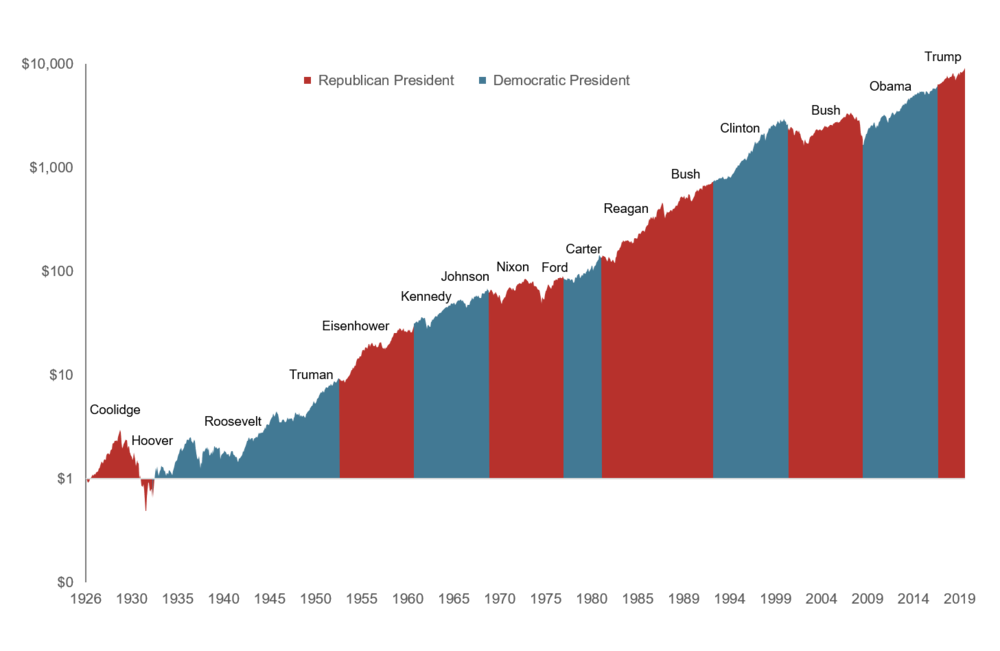

Elections & the Stock Market

An investor may ask, “Should I move to a more conservative allocation until after the election?” It’s a valid question. However, this question and thought process go against what we believe about the market and historical precedents.

Two Easy Steps to Protect Yourself from Identity Theft

One of the many risks to an individual/family’s wealth is identity theft. While you cannot control how companies protect your personal information, there are two easy steps you can take to reduce your risk by protecting your credit.

Don’t Waste This Crisis

Last May, we posted an article here entitled Five Ways to Get Ready for the Next Great Recession. Here we are. As fast as it takes to turn off a light, our robust economy has come to a screeching halt. This may or may not be the next Big One. We may have a V-shaped recovery, or this may turn into a depression. Time will tell. Over the last several weeks, there have been many anxious reactions to this crisis. You may have asked some of these questions:

CARES Act: The Coronavirus Stimulus Law

Know What You Can Expect from this New COVID-19 Recovery Effort; The pace of change this year is creating many opportunities for individuals and families to adjust their financial plans. With tax reform, the passage of the SECURE Act in December, the passage of the CARES Act in March, volatile capital markets, lower account values, and potential for lower revenue and income, many planning assumptions are obsolete. All of these current events can be used as a catalyst to revisit risk tolerance, investment plans, retirement plans, estate planning, insurance and asset protection, cash flow, debt, and business strategy to take advantage of the times. The public health crisis, which has morphed also into an economic crisis, is an opportunity for those who want to benefit from the times. Understanding the CARES Act will be a part of that process.

Five Ways to Get Ready for the Next Great Recession

In 1973, Six Flags Over Georgia introduced the Great American Scream Machine, which was, at the time, the largest and fastest roller coaster in the world. Riders were ratcheted to the top of a hill, dropped to the earth below, and then, just when they thought the worst was over, dropped again. Within just a few minutes, the ride was over, and victims were back where they started, with windblown hair, abdominal discomfort, a story to tell, and sometimes a commitment never to do something like that again. This classic roller coaster is still at Six Flags, dwarfed by several other taller and faster coasters.

Health Care Sharing Ministries – A Viable Alternative to Conventional Health Insurance?

Interest and participation in Health Care Sharing Ministries (HCSMs) has soared in recent years. Due to the rising cost of medical premiums, deductibles, procedure and facility fees, individuals and business are rethinking their options to control medical expenses.

The Equifax Breach: Protecting Yourself Against Identity Theft

The Equifax security breach is an issue you should be aware of, as it is a tipping point in the fight against cybercrime. Equifax, one of the three major credit bureaus, recently disclosed that their systems were hacked and that the personal data of up to 145 million people were stolen. The sensitivity of this data and the size of this breach mean that prudent consumers should change how they protect themselves. In the future, it is plausible that your personal data, including your date of birth, social security number, and credit report information, could be made available to the public.